After a two-year hiatus courtesy of the Covid-19 pandemic, the Contemporary Scholar Conference (CSC) finally took place this year, in Norfolk, UK. Lucie Douma and Parmindar Singh, 2022 Nuffield Scholars, attended and reported back on the event and their travels. The following article brings together these reports.

As part of their scholarship programme key milestones, they also compiled a brief insight work report.

Follow the links to read Lucie and Parmindar’s Insights Reports.

The 2022 Nuffield Contemporary Scholars Conference.

“Lucie Douma and I represented New Zealand this year. The Contemporary Scholars Conference was a great way to start the global aspect of our Nuffield Programme. The Conference provided an opportunity to meet global agricultural enthusiasts and build new network of connections,” says Parmindar Singh.

“Our hosting region, Norwich, is predominantly arable farming with notable long time family estates. The landscape, climate and access to water very much determines land use and production.

“Before the CSC, Lucie and I were very generously hosted by Christine and David Hill. David is a Nuffield Scholar who is still very active in the Nuffield community. David travelled the world to study biotech crops. His wife was a science teacher and very involved in agricultural education and research and is also actively involved in several Norfolk organisations working in this filed. They manage their 500+ha arable farm.

“David and Christine showed us around their neighbourhood, we visited a local dairy farm and learned about the Hill’s arable business and family history,” shares Parmindar.

Sharing New Zealand with the world.

New Zealand, our farming systems, and the positioning we have on global markets was part of virtually every conversation Lucie and Parmindar had at the CSC. This was driven in some part by a presentation Lucie and Parmindar gave to those attending. This was a brief overview of the New Zealand food and fibre sector.

“At the start of each day of the CSC, representatives of all participating nations were asked to share a short presentation of the agricultural sector in their respective countries. In all cases the ten-minute time limit was not enough, and we were no different,” shares Lucie. “For our presentation, Parmindar opened with our values and understanding towards agriculture and how we incorporate the principles of Whakapapa and Kaitiakitanga.

“I did the second half of our presentation and covered the key statistics of farming in New Zealand and shared our vision of fit for a better world.”

Parmindar adds, “ Learning from other scholars about their country and their agriculture, was always a highlight of the day. To be given the opportunity to explain more about what we do here at home was a time for reflection on how proud I am to be a New Zealand farmer.”

The CSC business hackathon.

One of the initiatives included in the conference programme was the so called “business hackathon” where each group of scholars visited four different businesses over one day.

“The visits started with a 20-minute induction about the business followed by a specific challenge. Then as a group, we had to come together with a result – a solution to the challenge. We then had to present this to our hosts at the end of each session,’ explains Lucie Douma.

“It was an interesting way to get to know more about some of the notable businesses in the region. I really enjoyed the exchanges we had during the hackathon with the other scholars and the local business community,” adds Parmindar.

Two years’ Nuffield Scholars get together.

This year’s conference was the first after a two-year hiatus caused by Covid restrictions around the world.

“It was great to have two years combined – instead of having 60 or 70 people, we had 140. Also attending were the 2020 UK Scholars and we got to meet some of the alumni,” recounts Lucie.

Parmindar agrees, “All in all, CSC was a full-on conference, where we had the opportunity to meet passionate and enthusiastic global agricultural leaders.

“Many scholars commented on how New Zealand punches above its weight and has created a name for itself as a premium agricultural production powerhouse. It seems we are known as a small country with a notable place in the premium agri-products market.

“We also touched on many global issues around climate, water, and soil management along with political tension particularly with Russia’s invasion of Ukraine and the associated concerns for global food security.

“We’ve both been reflecting on the last few weeks and feeling very privileged to have had the opportunity to engage with whanau from across the globe! Thank you Nuffield New Zealand, the CSC in Norfolk was invaluable,” concludes Parmindar.

Lucie’s post-conference travels: North England, Scotland, Shetland Islands, Norway and the Netherlands.

After the CSC, Parmindar travelled back to New Zealand to organise further travel plans for later in the year, while Lucie had the opportunity to further explore the United Kingdom and Europe.

She went to Wales, where unfortunately she tested positive for COVID and had to spend a week in isolation – giving her time to reschedule her itinerary.

“I went up through Northern England to The Lakes District and spent some time with farmers in Cumbria, and North Cumberland.

“What really struck me is that people were facing similar issues to what we do in New Zealand. Almost all farmers who have similar systems to us, are facing the same challenges with labour access and input costs. It’s a global problem, not a localised one.

“In Scotland, I visited Angus Soft Fruits. These growers supply 15 to 20% of all the fresh berries to UK supermarkets. It was interesting to talk to them and hear about the challenges they face with Brexit, and what they are doing to secure the labour they need to harvest. They need roughly 400 seasonal workers over the main picking period.

“They have contracts with growers in other countries like Morocco, Spain to ensure year-round berries are available for the UK supermarkets. It was informative to hear how they are dealing with the realities of modern farming,” says Lucie.

“The next stop was the Shetland Islands – probably the most eye-opening time I had. They farm so differently to us here in New Zealand, it’s a more community-based approach they have built there; where everybody supports each other,” explains Lucie.

“They don’t have the same labour challenges as larger farming operations do, because they operate as one community, they operate on mutual support – helping each other in times of need. That really came across in my conversations with the people there. They have an active young farmers group and I had the opportunity to spend a lot of time with them. I really enjoyed that,” concludes Lucie.

Next on the schedule was a visit to a Norwegian salmon farm. “This is an industry that has risen at pace and scale over the last few decades. The wild salmon population around the Norwegian coast numbers 500,000. This farm has 11 cages with the capacity to hold 1.8 million salmon and there are over 1000 farms in Norway such as this one.

They are very advanced in some respects. When it comes to data management, similar issues exist around data interoperability of systems as with the agriculture sector. Biosecurity is an important issue for them as well,” adds Lucie.

Lucie then headed to the Netherlands, but not before experiencing full Norwegian blizzard.

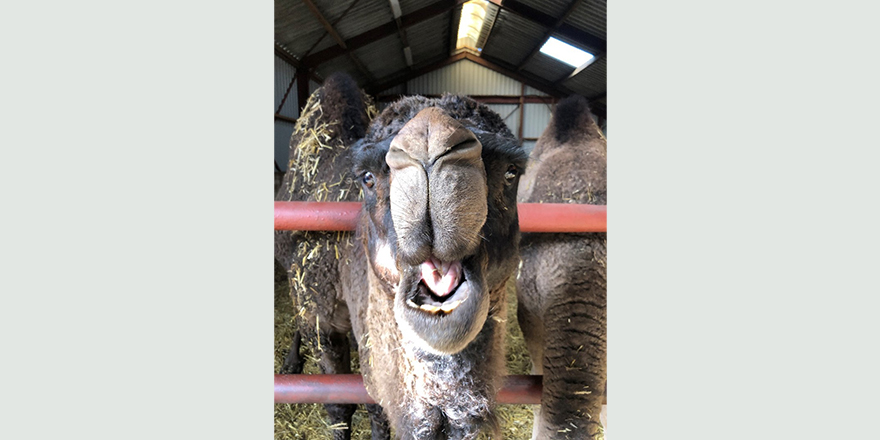

The Netherlands had a highly advanced agriculture sector. From traditional horticulture and animal farming through to developing new industries, including camel milking.

Land-use change in the Netherlands means incorporating energy production into the systems. Some arable farms where busy building large wind turbines and other farms had solar panel fields incorporated within them. Lucie visited advanced farming barns where the whole rood was covered in solar panels.

“With the Russia-Ukraine conflict, energy production and self-sufficiency has come to the forefront of farming. All farming systems I visited were diversified in some part, and they all had a farm shop in order to share the story of their produce and build strong connections with the local communities,” recounted Lucie.

You can read both Lucie and Parmindar’s Insights Reports here.